Introduction

In this article, we look at the Poor Man’s Covered Call, which is a synthetic version of a standard Covered Call. Both strategies start with an OTM Short Call as the premium generator, but while a standard Covered Call uses long shares for the bullish exposure, a Poor Man’s Covered Call uses a Long Call for the bullish exposure.

How to Reduce Risk trading the Poor Man’s Covered Call. The Poor Man’s covered call is an excellent strategy for new traders with smaller accounts because it can help reduce risk and require less capital to take a position in a stock than a covered call. Setup, management, and closing are also key factors to consider when using this strategy.

What are the benefits of trading the Poor Man’s Covered Call?

When allocating capital to an options position, a new trader with a smaller account must be mindful of the buying power required for each trade he or she decides to enter. Putting too much capital to work on one trade can hinder your ability to have a diversified portfolio of several trades.

In addition, too much capital in one trade increases your risk when markets get volatile.

What is the Poor Man’s Covered Call

This reason alone makes Poor Man’s Covered Call an excellent strategy for new traders. In addition, due to the lower capital requirement needed to set up this option strategy, it can be a valuable alternative to another strategy we have discussed in the past, namely the Covered Call option strategy.

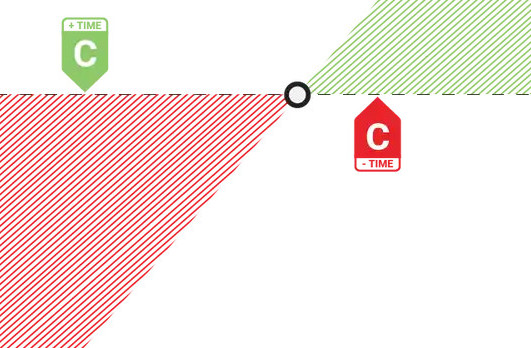

A “Poor Man’s Covered Call” is a Long Call Diagonal Debit Spread, that is used to replicate a covered call position. The strategy gets its name from the reduced risk and capital requirement of the standard covered call. (See Covered Call).

The trade is put on for a debit, which means the most you can lose is the amount you paid for the trade.

The PMCC is a way to replicate trading covered stock. Sometimes referred to as synthetic long stock. A synthetic long asset is a strategy for options trading that is designed to mimic a long stock position.

How to set up the PMCC

The basic set up for the Poor Man’s Covered Call is to buy an in-the-money long call in a farther outdated cycle and simultaneously sell an out of the money short call in a closer expiration cycle. The trade is put on for a debit with the short call reducing the cost of the long option.

In order to effectively set up this strategy, you must check the extrinsic value of the long dated in-the-money option. We do this to ensure the near-term short option we sell has greater extrinsic than the long-term option. In addition, we make sure we don’t pay more for the trade than 75% of the width of the strikes.

If the concept of extrinsic value is a little fuzzy, you can check out my post on the subject here. I realize it does seem that under one rock is another smaller rock that needs exploring. But that is part of the enjoyment of options trading. Anyone can buy a stock and hope it will go up.

But you didn’t decide to learn to trade options because you want to sit and watch stocks move around. Did you?

Knowing about the moving parts of options will make you a much better trader. You will know what makes one trade better than another and why you should be selling options while everybody else is buying high priced stock.

Without getting into the weeds of intrinsic and extrinsic value. Let’s just say that the premium you receive for the out of the money call you sell must be greater than the extrinsic value of the long call premium.

How to Manage the PMCC

For a losing trade due to the stock falling in price, the short call can be rolled to a lower strike for a credit to help reduce the basis in the trade.

When to close the Poor Man’s Covered Call

Naturally, we want to close this strategy for a profit. We will see this if the price increases significantly in one of the expiration cycles because the call option will then trade for close to its intrinsic value. After this point the profit potential will diminish.

Final Thoughts

The Poor Man’s Covered Call is an excellent strategy for traders with smaller accounts who still would like to participate in the potential upside move of higher priced stocks. This strategy is a synthetic version of the Covered Call which can help you reduce risk by requiring much less buying power to enter the trade. Being aware of the size of the debit paid and the extrinsic value of the long and short calls is particularly important when using this strategy.

Please share your thoughts and suggestions in the comment section below