Today we will look at How to Setup Options Trades.

We will consider the five key metrics to use when setting up a trade. In addition we will discuss why these metrics are important and how they impact your trading decisions.

How to Setup Options Trades. When you set up an options trade you need to remember 5 Key metrics. You should always consider liquidity, your directional assumption, the level of implied volatility, delta, and the probability of profit.

Liquidity

What do we mean by good liquidity?

The more buyers and sellers there are for a given options contract the narrower the bid/ask spread. And the narrower the spread, the more liquid (easier to trade) the option should be. When we trade highly liquid options, our ability to get in and out of the trade in a timely manner improves significantly.

Develop a directional assumption

After you determine that the underlying has good liquidity. You want to look at the current price range of the underlying. If the stock is trending either bullish or bearish. Maybe the stock has been trading in a narrow range over the course of the past few weeks.

Historical price charts such as candlestick charts will help you determine where the stock is currently trading.

In addition, some traders use support and resistance lines to give further weight to their directional assumption.

The main idea here is to determine if you are bullish or bearish on the underlying.

When determining strike selection consider the typical price movement of the underlying stock. Has the stock been trading in a narrow or wide range on a daily basis?

Price movement of the underlying is an important part of market awareness.

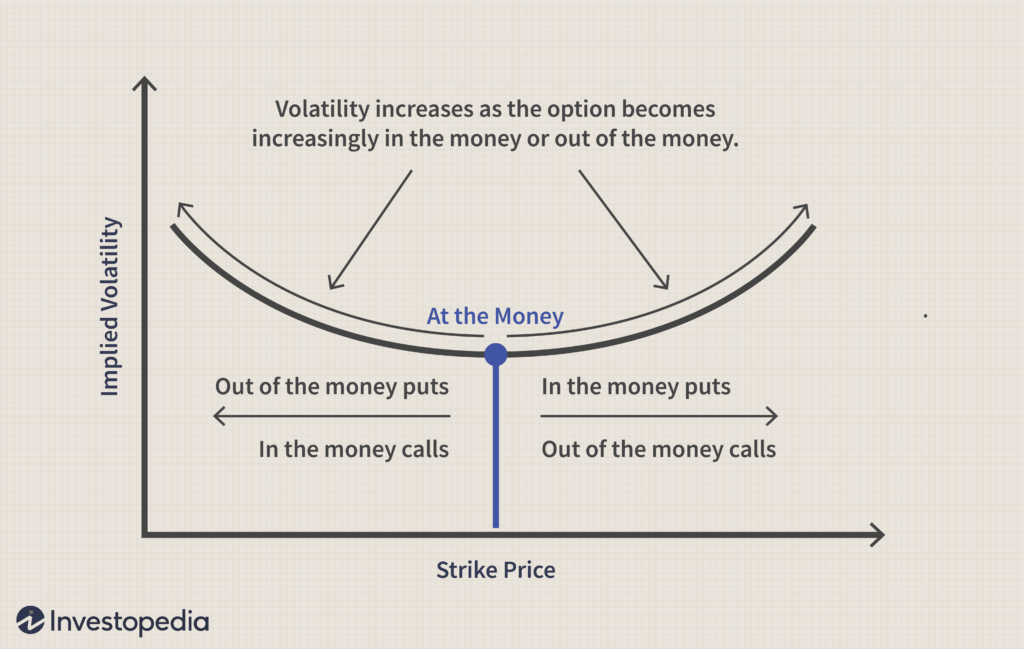

Know the current state of Implied Volatility

Trade where the stock has a statistical significance. Implied volatility is a measure of expected move. Opportunity to make more money is higher when the volatility is higher. Implied volatility contracts more than it expands, and we want to put ourselves in a position to take advantage of that contraction,

If the underlying has been on a steady rise in price and the volatility has fallen, the expected move will narrow and reflect that decrease in implied volatility.

Identify a time frame (expiration month) to trade.

Timeframe is critical in options trading. Extensive research by the analysts at tasty trade have found that 45 days to expiration is the optimal timeframe in which to place a trade.

Determine the Risk profile of the underlying

At its most basic level “delta” helps determine the position’s risk. For instance, if a position has a delta of +50, theoretically the option will move $.50 for every $1.00 move in the underlying.

Delta ranges from -100 to +100.

Obviously, the higher the delta, the more the option will move. But delta works in both directions. If your option position has a -50 delta and the underlying moves up $1.00, your position will lose $.50.

There is more to delta than just price movement, and we will cover those ideas in future posts.

So, just keep delta in mind when setting up your trades

Final Thoughts

Options trading can be a challenging undertaking. There are many moving parts and each one can have an impact on your trading positions. But, if you break down the process into some simple reproducible steps, you will find the process much more enjoyable. In time you will gain confidence in your trading decisions. And by considering these 5 metrics you will find many new trading opportunities.

Please share your thoughts and suggestions in the comment section below