Today I want to give you a brief overview of the short put strategy. If you are looking to profit from the rise in the underlying stock, this is a great strategy to use. In addition, if you want get long stock at a price below the current price of the underlying, then the short put is a great strategy to trade.

Let’s take a look at how to trade this strategy.

Short Put Option Strategy is employed when a trader sells or writes a put option on an underlying security. A trader does this in order to profit from an increase in the stock’s price by collecting a credit for the sale of the option contract.

What is the short put

The Short Put Options Strategy is a popular options trading strategy used by investors who are bullish on an underlying stock or ETF. This strategy involves selling or writing put options, which gives the seller the obligation to buy the underlying asset at a specific price (strike price) before the expiration date. The trader receives a credit for placing this trade. This credit reduces the cost of the underlying in the event the option is assigned.

Here are the steps for trading the short put option strategy:

1. Choose the underlying asset

Select a stock or ETF that you are bullish on and that has options available for trading.

Read this discussion on trading disciplined and trade set up

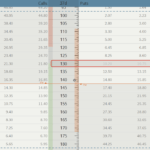

2. Determine the strike price and expiration date:

Decide on the strike price and expiration date for the put options you want to sell. The strike price should reflect the price at which you would be comfortable buying the underlying asset if you are assigned.

3. Sell the put options:

Sell one or more put options at the strike price and expiration date you have chosen. You will receive a credit from the buyer of the put option, which is the maximum profit you can make on the trade.

4. Monitor/manage the trade:

Keep an eye on the underlying asset’s price and the put option’s price. If the underlying asset’s price remains above the strike price until expiration, the put option will expire worthless, and you will keep the credit as profit. If the underlying asset’s price falls below the strike price, you may be assigned and required to buy the underlying asset at the strike price.

5. Close the trade:

If you want to exit the trade before expiration, you can buy back the put option you sold to close out the position. The price you pay to buy back the put option will depend on the underlying asset’s price and the time remaining until expiration.

Final thoughts

Remember that selling put options involves risk and should only be done with a clear understanding of the strategy and its potential outcomes. It is essential to have a plan in place for managing the trade if the underlying asset’s price moves against you.

Please share your thoughts and suggestions in the comment section below

Happy Trading!