Options trading has become an increasingly popular way for investors to enhance their portfolios, manage risk, and potentially generate additional income. While options can offer powerful advantages, they also require a solid understanding of core concepts and strategies. This comprehensive guide breaks down everything you need to know about options trading – from fundamental principles to intermediate-level techniques.

Whether you’re looking to hedge your investments, generate regular income, or leverage your capital for potentially higher returns, this guide will walk you through the essential knowledge and practical strategies you need to start trading options confidently and responsibly.

We’ll begin with the basics and progressively build toward more sophisticated concepts, ensuring you develop a strong foundation before advancing to more complex strategies. Each section includes practical examples and key takeaways to help reinforce your understanding.

Listen to this brief discussion of the benefits of Options Trading for Beginners of any age

Foundations: Understanding Options

1. What Are Options?

Options are financial derivatives that give buyers the right, but not the obligation, to buy or sell an underlying asset at a specific price (strike price) before a specified expiration date. They are used for hedging, speculation, and leveraging investments.

2. Call vs. Put Options

A call option gives the right to buy the asset, while a put option gives the right to sell it. Call options are used when expecting a price increase; puts are used for price drops or hedging.

3. Key Terms to Know

Essential terms include premium (the cost of an option), strike price, expiration date, and the underlying asset (e.g., a stock or index). Understanding these is foundational for trading.

4. Why Trade Options?

Options offer leverage, meaning smaller investments can yield significant returns. They also provide flexibility, allowing traders to hedge risks or generate income through strategies like covered calls.

5. Understanding Risk and Reward

Options have defined risks: buyers risk losing the premium paid, while sellers face potentially unlimited losses. Understanding these trade-offs is crucial.

6. The Role of Options in a Portfolio

Options can enhance portfolio performance by reducing risk through hedging, generating income, or enabling speculation with limited capital.

How Options Work

7. Options Contracts Explained

Each options contract typically represents 100 shares of the underlying asset. These standardized terms make trading efficient.

8. How Are Options Priced?

Pricing depends on intrinsic value (difference between the stock price and strike price) and extrinsic value (time left until expiration and volatility).

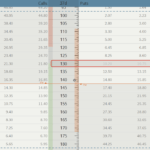

9. Introduction to the Options Chain

An options chain lists all available options for a given stock, showing strike prices, expiration dates, and prices (bid/ask) for calls and puts.

10. The Role of the Options Market

Options markets provide liquidity and enable hedging and speculative trading. Key participants include retail traders, institutional investors, and market makers.

Basics of Options Pricing

11. Intrinsic Value vs. Extrinsic Value

Intrinsic value reflects the “real” value of an option (in-the-money amount), while extrinsic value represents the premium paid for time and volatility.

12. The Greeks

Delta measures sensitivity to stock price changes, gamma measures delta’s change, theta tracks time decay, vega measures volatility impact, and rho tracks interest rate effects.

13. Implied Volatility

Implied volatility reflects market expectations of future price movement. High volatility increases options prices due to greater uncertainty.

14. The Impact of Time Decay

Time decay (theta) erodes an option’s extrinsic value as expiration nears. Buyers lose value over time, while sellers benefit from decay.

15. Buying Calls

Buying calls is a bullish strategy. Traders pay a premium, expecting the stock price to rise above the strike price by expiration.

16. Buying Puts

Buying puts is a bearish strategy. Traders gain if the stock price drops below the strike price before expiration.

17. Covered Calls

Covered calls involve selling call options against owned shares. It’s a conservative income strategy but caps upside potential.

18. Cash-Secured Puts

This strategy involves selling put options with cash set aside to buy the stock if assigned. It’s a conservative way to earn premiums.

19. The Importance of Strike Price Selection

Choosing a strike price involves balancing affordability and likelihood of profitability. ATM (at-the-money) strikes are popular for beginners.

20. Setting an Expiration Date

Longer expirations provide flexibility but cost more, while shorter expirations are cheaper but riskier due to time decay.

Risk Management and Psychology

21. Understanding Maximum Risk and Reward

Call/put buyers risk the premium but have unlimited potential profit, while sellers face higher risk but limited rewards.

22. Position Sizing

Position sizing prevents overexposure to one trade. Beginners should only risk a small percentage of their portfolio on any trade.

23. The Importance of a Trading Plan

A trading plan defines your entry/exit points, risk tolerance, and strategy, helping you stay disciplined and avoid emotional decisions.

24. Emotional Discipline in Trading

Options trading can be volatile, and emotions like greed or fear lead to mistakes. Sticking to a plan reduces these risks.

Intermediate Strategies

25. Debit Spreads

Debit spreads involve buying and selling options to limit costs. Example: Bull call spreads profit from moderate price increases.

26. Credit Spreads

Credit spreads involve selling high-premium options and buying lower-premium ones, profiting from time decay and small price movements.

27. Iron Condors

This strategy combines credit spreads on both sides of the options chain, profiting from low volatility and range-bound markets.

28. Protective Puts

Buying a protective put hedges against downside risk in a stock position, like insurance for your portfolio.

29. Collars

Collars combine protective puts with covered calls to limit both upside and downside risks, useful in volatile markets.

Analyzing Markets for Options

30. Technical Analysis for Options Traders

Chart patterns, trends, and indicators like RSI or moving averages help traders time entries and exits effectively.

31. Fundamental Analysis and Options

Evaluating a company’s financials, earnings, and industry conditions helps align options trades with longer-term trends.

32. The Impact of Market Volatility

High volatility increases premiums, while low volatility favors sellers. Understanding volatility helps choose the right strategy.

33. Earnings and Event Trading

Options allow traders to speculate on earnings announcements or events without owning the stock, balancing risk and reward.

Execution and Advanced Considerations

34. Choosing the Right Broker

Look for platforms offering low commissions, user-friendly interfaces, and educational resources tailored for beginners.

35. Avoiding Common Beginner Mistakes

Mistakes like overleveraging, ignoring time decay, or failing to plan exits can be costly. Education and practice mitigate these errors.

36. Scaling Up Your Strategies

Once comfortable with basics, traders can explore advanced strategies, increase trade sizes, and diversify into multiple assets.