Revised 2/21/2023

It’s easy to feel like a deer in the headlights when the moment comes to put on your first trade.

Every new trader feels this way at the beginning.

You want that first trade to be a winner to get you off on the right foot. Believe me, I know how that feels,

I felt the same when I began to trade.

But have no fear.

The decision is much easier than you think.

So let’s take a look three most important factors to consider when looking for a trade and why using defined risk strategies is important for beginners.

Best first trades for beginners

Main Factors

The first steps in setting up a trade is to understand these factors…Liquidity…Volatility…Probability.

In addition, we want to be sure to trade only highly liquid stocks.

Defined Risk

Every trade has risks. It doesn’t matter, if it’s the best stock in the world it still has risk. A stock can go down on the same day that you buy it. If fact a stock purchase is no more than a 50:50 bet. This is one of the main reasons traders find options trading so attractive You can make money, if the underlying stock goes up, remains neutral or even goes down a bit. These are realities you come to be deeply aware of So with that in mind, it is best to define the amount of risk you are willing to take at the outset.

Covered calls

Every Options strategy is a combination of puts and calls. This is always true whether the trade is simple or complex. Puts and calls are the basic building blocks of every strategy.

A covered call is the name given to the strategy by which one sells a call option while simultaneously owning the obligated number of shares of the underlying stock. The call writer should be neutral to bullish on the stock. By writing the call the trader decreases the risks of owning the stock. This is what you want. Right? You want to define your risk. It is also possible to profit if the stock declines in price. And, if the stock remains below the strike price, you get to keep the stock and the credit you received when you sold the call.

A Covered Call is a common strategy that is used to enhance a long stock position. The position limits the profit potential of a long stock position by selling a call option against the shares. This adds no risk to the position and reduces the cost basis of the shares over time.

Directional Assumption: Bullish

Setup:

– Buy 100 shares of stock

– Sell 1 call for every 100 shares. The short call is usually At-The-Money (ATM) or Out-Of-The-Money (OTM)

Ideal Implied Volatiliy Environment : High

Max Profit: Distance between stock price & short call + premium received from selling the call

How to Calculate Breakeven(s): Stock price – credit from short

Trade approach:

We almost always prefer covered calls to naked stock because it allows us to profit when the stock doesn’t move at all, and it also reduces our max loss if the stock goes down. It’s important to consider the credit received from the call when deploying this strategy. If we can only collect $0.10 by selling the call, we may consider another strategy or hold off on selling the call until we can find more premium.

We look to deploy this bullish strategy in low priced stocks with high volatility. Based on our studies, entering this trade with roughly 45 days to expiration is ideal. We typically sell the call that has the most liquidity near the 30 delta level, as that gives us a high probability trade while also giving us profitability to the upside if the stock moves in our favor.

Trade tips:

When do we close Covered Calls?

We close covered calls when the stock price has gone well past our short call, as that usually yields close to max profit. We may also consider closing a covered call if the stock price drops significantly and our assumption changes.

When do we manage Covered Calls?

We roll a covered call when our assumption remains the same (that the price of the stock will continue to rise). We look to roll the short call when there is little to no extrinsic value left. For instance, if the stock price remains roughly the same as when we executed the trade, we can roll the short call by buying back our short option, and selling another call on the same strike in a further out expiration. We will also roll our call down if the stock price drops. This allows us to collect more premium, and reduce our max loss & break even point. We are always cognizant of our current break even point, and we do not roll our call down further than that. Doing so can lock in a loss if the stock price actually comes back up and leaves our call ITM.

Vertical Spreads

A vertical spread is a directional strategy made up of long and short puts/calls at different strikes in the same expiration. Vertical spreads allow us to trade directionally while clearly defining our maximum profit and maximum loss on entry (known as defined risk).

Long Call Vertical Spread

A long call vertical spread is a bullish, defined risk strategy made up of a long and short call at different strikes in the same expiration.

Directional Assumption: Bullish

Setup:

– Buy ITM Call

– Sell OTM Call

Ideal Implied Volatility Environment: Low

Max Profit: Distance Between Call Strikes – Net Debit Paid

How to Calculate Breakeven(s): Long Call Strike + Net Debit Paid

Long Put Vertical Spread

A long put vertical spread is a bearish, defined risk strategy made up of a long and short put at different strikes in the same expiration.

Directional Assumption: Bearish

Setup:

– Buy ITM Put

– Sell OTM Put

Ideal Implied Volatility Environment: Low

Max Profit: Distance Between Put Strikes – Net Debit Paid

How to Calculate Breakeven(s): Long Put Strike – Debit Paid

Short Call Vertical Spread

A short call vertical spread is a bearish, defined risk strategy made up of a long and short call at different strikes in the same expiration.

Directional Assumption: Bearish

Setup:

– Sell OTM Call (closer to ATM)

– Buy OTM Call (further away from ATM)

Ideal Implied Volatility Environment: High

Max Profit: Credit received from opening trade

How to Calculate Breakeven(s): Short call strike + credit received

Short Put Vertical Spread

A short put vertical spread is a bullish, defined risk strategy made up of a long and short put at different strikes in the same expiration.

Directional Assumption: Bullish

Setup:

– Sell OTM Put (closer to ATM)

– Buy OTM Put (further away from ATM)

Ideal Implied Volatility Environment: High

Max Profit: Credit received from opening trade

How to Calculate Breakeven(s): Short Put Strike – Credit Received

Trade approach:

Vertical spreads allow us to trade directionally while clearly defining our maximum profit and maximum loss on entry (known as defined risk).

While implied volatility (IV) plays more of a role with naked options, it still does affect vertical spreads. We prefer to sell premium in high IV environments, and buy premium in low IV environments. When IV is high, we look to sell vertical spreads hoping for an IV contraction. When IV rank is low, we look to buy vertical spreads to stay engaged and also use it as a potential hedge against our short volatility risk.

Since the maximum loss is known at order entry, losing positions are generally not defended. We always look to roll for a credit in general, and doing so with vertical spreads is usually difficult.

Trade tips:

When do we close vertical spreads?

Profitable vertical spreads will be closed at a more favorable price than the entry price (goal: 50% of maximum profit

When do we manage vertical spreads?

Losing long vertical spreads will not be managed but can be closed any time before expiration to avoid assignment/fee

The basic idea behind spreading is that the trader is using the sale of one call to reduce the risks of buying another call.

A spread is a transaction is one in which a trader simultaneously buys one option and sells another with different terms on the same underlying stock. In a call spread the options are al calls.i . If we are bullish, we sell a Put vertical, If bearish we sell a call vertical. This strategy uses much less buying power that the covered call because we are not buying the underlying stock.

An example would be a stock like XYZ. We sell an otm call and buy a further OTM call to define the risk if the stock goes up

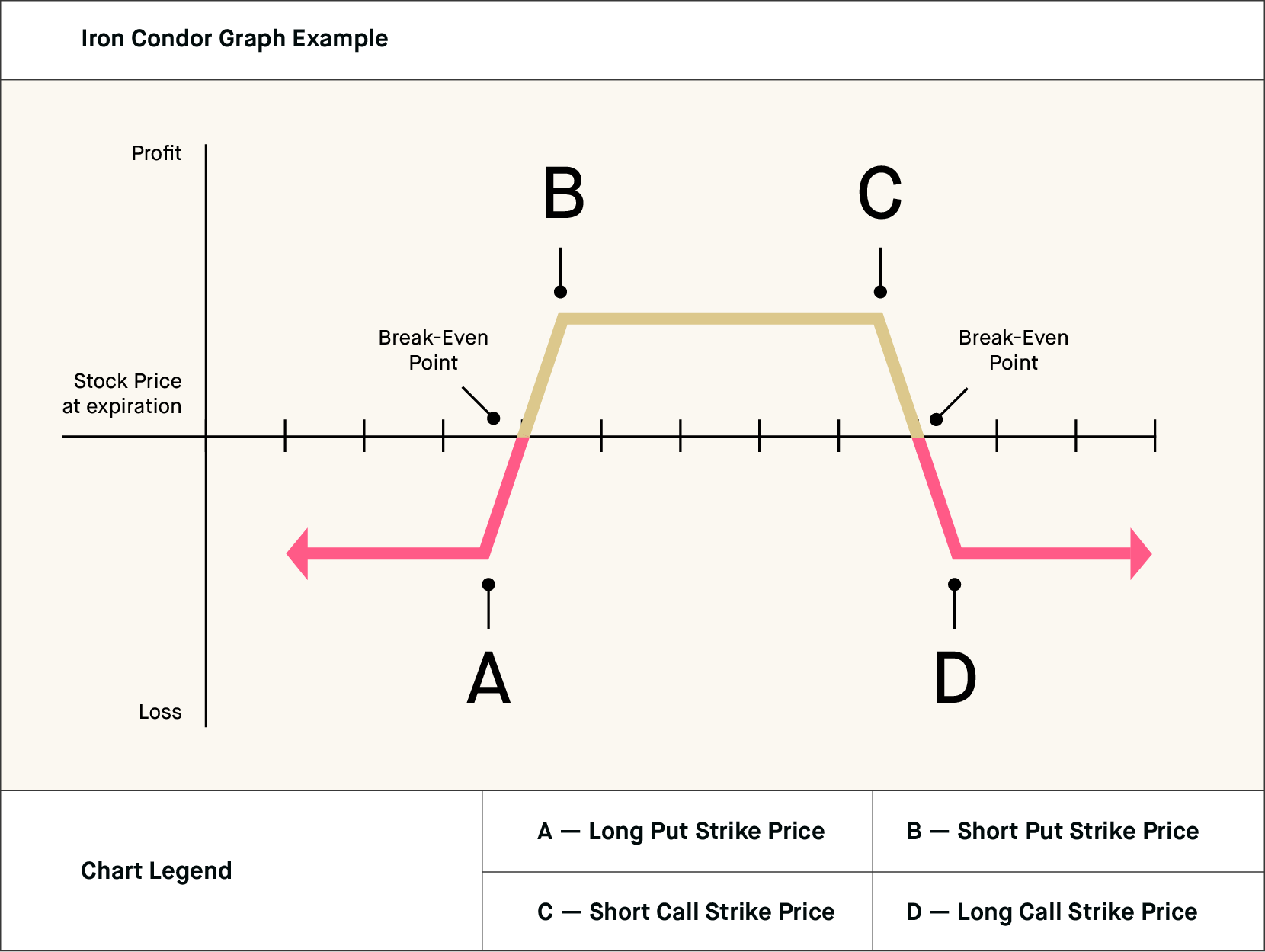

Iron Condors

This is one of my favorite defined risk trades. It is a combination of a put vertical and a call vertical and is generally used when a trader has a neutral bias and feels the stock will trade within a given range up to the expiration date of the trade.https://optionsactions.com/beginning-options-trader/

An Iron Condor is a directionally neutral, defined risk strategy that profits from a stock trading in a range through the expiration of the options. It benefits from the passage of time and any decreases in implied volatility.

Directional Assumption: Neutral

Setup:

– Sell OTM Call Vertical Spread

– Sell OTM Put Vertical Spread

Ideal Implied Volatility Environment : High

Max Profit: The maximum profit potential for an Iron Condor is the net credit received. Maximum profit is realized when the underlying settles between the short strikes of the trade at expiration.

How to Calculate Breakeven(s):

– Upside: Short Call Strike + Credit Received

– Downside: Short Put Strike – Credit Received

Our trade approach:

We approach iron condors with similar entry tactics. We shoot for collecting 1/3rd the width of the strikes in premium upon trade entry. For example, if we have an iron condor with three point wide spreads, we will look to collect $1.00 for the trade. This gives us a probability of success around 67%, which is acceptable to us.

Trade Tips

When do we close Iron Condors?

Much like other standard premium selling strategies, we close iron condors when we reach 50% of our max profit. This can increase our win rate over time, as we are taking risk off the table and locking in profits.

When do we manage Iron Condors?

We manage iron condors by adjusting the untested side, or profitable side of the spread. We look to roll the untested spread closer to the stock price to collect more premium. We can go as far as rolling our untested spread to the same short strike as our tested spread, which creates an Iron fly. !