To start off the New Year we are starting our new series” A Beginners Guide to Options Trading: Unlocking the Path to Financial Freedom”. Options trading can be an exciting and potentially profitable venture, especially for beginners. In this guide, we’ll cover the essentials of options trading and provide you with the knowledge you need to get started.

In the coming weeks we’ll cover Concepts every trader needs to know, Strategies you can easily implement, and the Trade and Portfolio Management tools and techniques you need to keep your trading going in the right direction.

Please feel free to send your request for topics you would like to read about.

Let’s start with the basics.

What exactly is options trading? In simple terms, options are financial instruments that give you the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specific timeframe. Options trading can be particularly appealing to beginners because it offers flexibility and limited risk compared to other investment strategies.

Understanding Options

Before diving into options trading, it’s crucial to understand how options work. There are two types of options: call options and put options. A call option gives you the right to buy an underlying asset, while a put option gives you the right to sell it. It’s important to grasp the concepts of intrinsic value and time value of options as well. Here is a link to the best book about options trading.

Risk and Reward

As with any investment, options trading involves risks. It’s essential to understand the potential profits and losses associated with options trading. Additionally, options trading allows for leverage, which can amplify both gains and losses. To manage risk effectively, it’s crucial to learn about position sizing and how to set stop-loss orders.

Types of Options Strategies

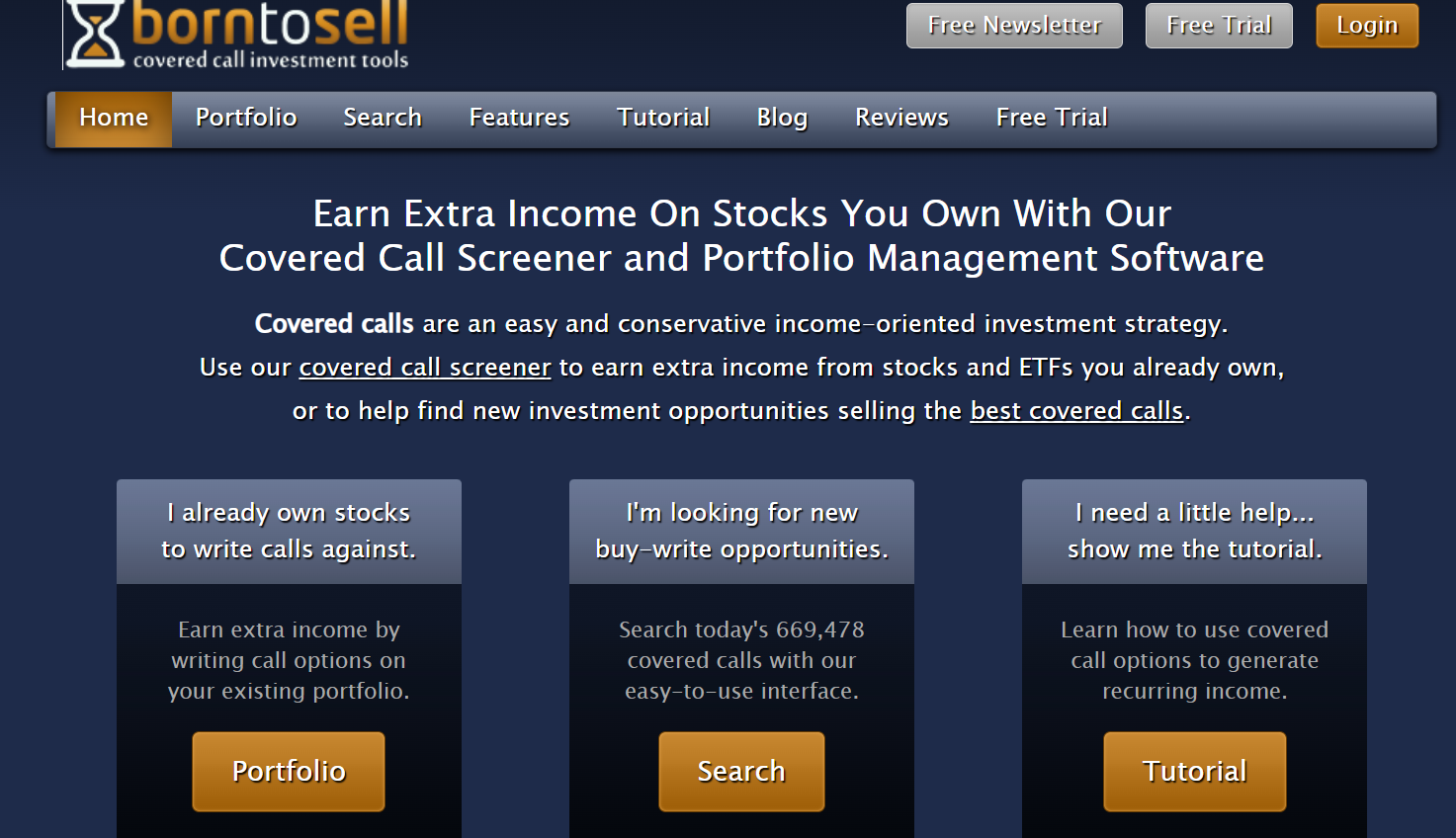

Options trading offers a wide range of strategies to suit different objectives and risk tolerances. Some common strategies for beginners include long calls and long puts, covered calls and cash-secured puts, vertical and horizontal spreads, as well as straddles and strangles. Each strategy has its own advantages and considerations.

Options Pricing

Understanding options pricing is key to making informed trading decisions. Several factors influence options prices, including the underlying stock price, time to expiration, and implied volatility. It’s also important to familiarize yourself with the Greeks, which are mathematical measurements used to assess the sensitivity of options prices to various factors.

Research and Analysis

Successful options trading requires proper research and analysis. Fundamental and technical analysis techniques can help you identify potential entry and exit points for your trades. Additionally, there are options-specific indicators and tools that can assist you in making informed decisions.

Common Mistakes to Avoid

As a beginner options trader, it’s crucial to be aware of common mistakes and pitfalls. Overtrading and excessive risk-taking can lead to significant losses. Having an exit strategy in place is essential to protect your capital. Properly managing your position size and risk is also crucial for long-term success.

Resources for Further Learning

Learning about options trading is an ongoing process. To continue expanding your knowledge, we recommend exploring books, websites, and courses that cater to beginner options traders. These resources can provide valuable insights, strategies, and examples to further enhance your trading skills.

Conclusion

In conclusion, options trading offers a world of opportunities for beginners. By understanding the fundamental concepts, managing risks effectively, and continuously learning, you can embark on a successful options trading journey. Remember, this guide is just the beginning. Feel free to explore each topic in more depth and practice your skills in a simulated trading environment.

Happy trading!

Please leave your questions, comments, and suggestions in the section below.