I’m going to kick things off by breaking down the basics of supply and demand. Imagine you’re at a market. You see stalls filled with fruits, vegetables, and all sorts of goods. Each stall owner decides how much to charge, and you decide what and how much to buy. That’s the crux of supply and demand.

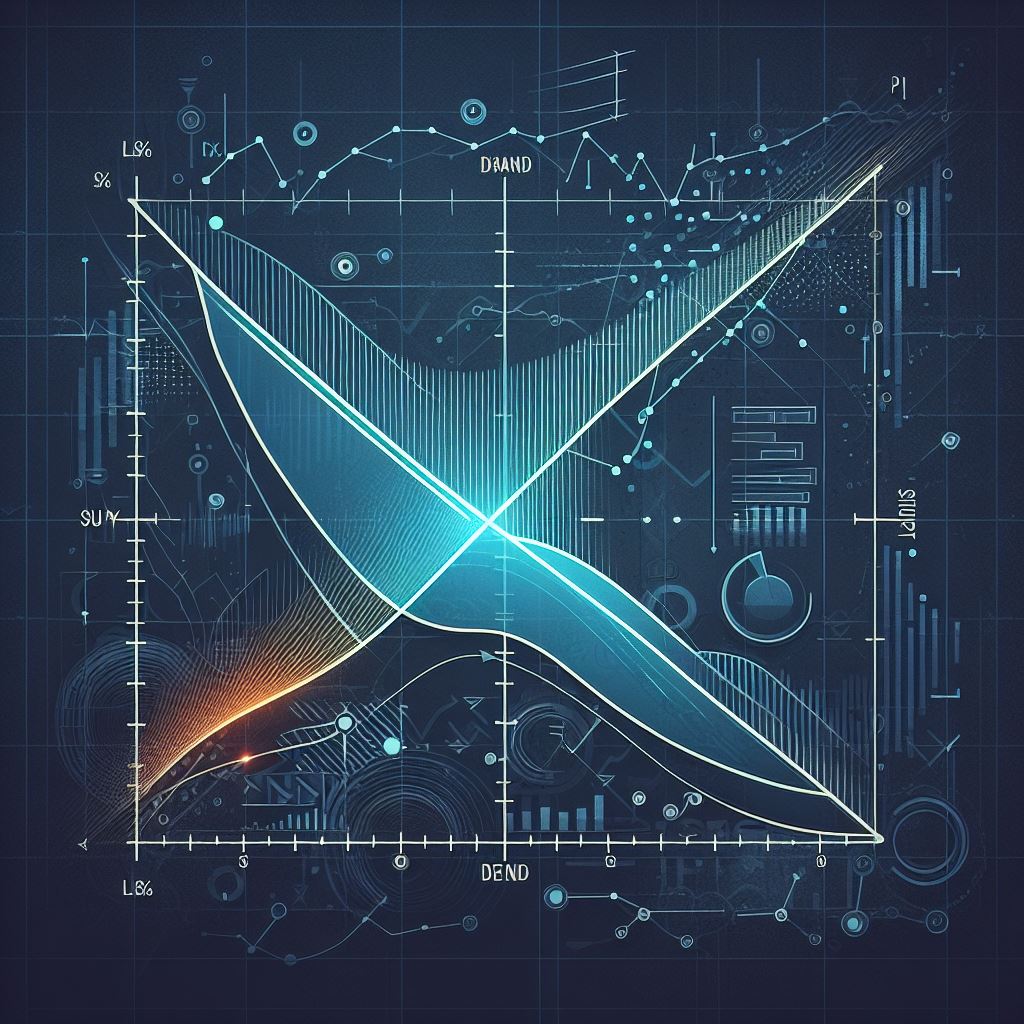

What’s truly fascinating is how supply and demand curves map out this scenario. The supply curve slopes upwards, showing that as prices rise, producers are willing to supply more. Conversely, the demand curve slopes downwards, since as prices increase, consumers generally want less.

This isn’t just about higher or lower prices, it’s also about quantity. The law of supply tells us that producers will offer more for sale at higher prices due to the potential for more profit. On the flip side, the law of demand asserts that consumers will purchase less at higher prices because, well, we all have a budget to stick to.

The magic happens at the point where these two laws balance each other out, creating what’s known as market equilibrium. It’s the sweet spot where the amount of goods consumers want to buy exactly matches the amount producers want to sell, at a price that’s agreeable to both parties.

The Dynamic Dance of Prices: Supply and Demand Interactions

Think of supply and demand as partners in a dance that determines how much you’re going to pay for everything from a loaf of bread to a new car. The price of goods isn’t just a random number; it’s a delicate balance between how much of something is available and how much people want it.

Consider a hot new tech gadget that’s just hit the market. If the manufacturer can’t keep up with the high demand, the price might shoot up. Conversely, if they produce too many and not enough people want to buy it, you’ll likely see discounts and deals.

Price elasticity is a key term here. It measures how sensitive a product’s demand is to price changes. Some items, like essential medicines, have inelastic demand; no matter the price, people still need them. On the other hand, luxury goods are usually more elastic; as prices increase, demand tends to drop off.

Real-world events profoundly impact supply and demand. For example, the orange juice market often sees a surge in prices if there’s an imminent threat of a hurricane damaging orange crops in Florida. These external factors can make markets volatile and unpredictable.

Beyond the Basics: Complexities in Real Markets

Navigating the market’s reality, you’ll discover that supply and demand are influenced by more than just individual preferences and production capabilities. These fundamental forces are often shaped by government policies, consumer behavior patterns, and intricate supply chains.

Now, what is the government’s role here? Well, they can step in with price controls to cap the cost of essential goods, impose tariffs to protect domestic industries, or provide subsidies to support particular sectors. These interventions can distort the free market’s natural flow, leading to either excess supply or demand.

Consumer behavior is another twist in this tale. Marketing campaigns, brand loyalty, consumer trends, and seasons all throw a wrench into the straightforward supply and demand model. These factors can suddenly shift demand, pushing the market to adapt.

Consider the global dance of supply chains. Have you ever thought about how a local factory shutdown can ripple through the market and affect global prices? That’s supply chain interdependence for you. It ensures that a hiccup in one part of the world can escalate to affect supply and demand worldwide.

Interconnectedness is a modern market hallmark, with global events causing waves across international economies. For instance, a political event in one country can decrease supply, causing prices to surge elsewhere. This scenario highlights the sophisticated web of cause and effect that governs our economic reality.

In summary, while the concept of supply and demand may seem simple at a glance, the market complexity is profound. With government, consumer behavior, and supply chains at play, understanding the full picture requires a keen eye on the broader economic environment.

Applying Supply and Demand Principles in Everyday Economics

Now, let’s talk about how understanding supply and demand can make a real difference in your daily life. If you’re a consumer, this can mean getting the best deal on the products you love.

By keeping an eye on market trends, you can anticipate changes in prices and plan your purchases. Buying seasonal items off-season or stocking up during a surplus can lead to significant savings.

For business owners and entrepreneurs, mastering supply and demand curves is vital. It’s going to dictate your inventory decisions, inform your pricing strategy, and ultimately, impact your profitability.

Don’t worry too much about getting every prediction right. The market is often unpredictable, but having a firm grasp on supply and demand gives you a strong foundation to make informed decisions.

For those of you eager to dive deeper, there are numerous books, online courses, and workshops that can expand your understanding of economics. Choose something that resonates with you, whether it’s a beginner’s guide or an advanced economic theory class.

Final thougts

Lastly, stay curious about the future trends in economics. Keep in mind that while history often repeats itself, innovation and global developments can shift supply and demand in ways we’ve yet to see.

If you’d like to hear a professional take on the current state of supply and demand, this podcast (here) is an eye opener.

In my opinion, the beauty of economics lies not just in the theories but also in their application to real-world scenarios. As you navigate the complexities of the market, remember: your first attempt doesn’t need to be your last. Adjust your strategy, keep learning, and you’ll find plenty of opportunities to apply the timeless principles of supply and demand to your advantage.